[Lim Jeong-yeo, Edaily Reporter] On June 13, the Korean stock market saw diverging moves in the biopharma and medical device sector. Shares of PharmaResearch, a company known for skin booster ‘Rejuran’, fell sharply after it announced a spin-off. Meanwhile, Nibec, a novel drug developer, picked up after a spike-and-dip following a license-out announcement. Nibec’s improved financial structure due to convertible bond (CB) conversions also caught attention, with debt shifted to equity.

|

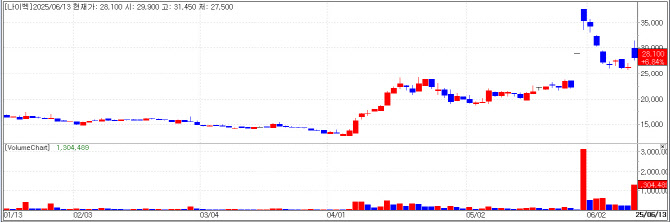

| PharmaResearch chart(Cred=KG Zeroin MP DOCTOR) |

PharmaResearch Slumps on Spin-off Announcement

According to KG Zeroin’s MP Doctor (formerly Market Point), PharmaResearch closed the day down 17.11% at KRW 433,500, falling from KRW 525,000. The plunge followed the company’s announcement of a spin-off and conversion to a holding company structure, which the market interpreted negatively. Trading volume spiked to 897,628, about 9 times the previous day’s volume of 96,596.

Although shareholders will receive an equal split of shares in the holding company and the new business entity, dissatisfaction stems from the valuation allocation, which gave 75% to the holding company and only 25% to the new company--which will operate the flagship Rejuran business.

PharmaResearch is best known for Rejuran, a skin booster product. As of now, its KOSDAQ market capitalization is approximately KRW 4.56 trillion. In Q1 2025, revenue rose 56% YoY to KRW 116.9 billion, operating profit increased 1.6 times to KRW 44.7 billion, and net profit nearly doubled to KRW 36 billion. The company has posted a robust 5-year CAGR of 33.95% between 2020 and 2024.

Management stated the shift to a holding company structure is meant to separate investment and business activities, optimizing each. PharmaResearch had acquired control of CTCBio over the last two years, a process that drew scrutiny and raised concerns about distraction from its core business. Under the new structure, PharmaResearch Holdings will manage investments, while the new entity (PharmaResearch) will handle operations.

However, it is widely believed in the industry that the restructuring is also tied to succession planning. The roles of Chairman Jung Sang-soo’s son Jung Rae-seung and daughter Jung Yoo-jin are growing, and having a single holding company oversee the group could solidify the family’s grip on the business.

Post-spin-off, if share transactions, mergers, or asset transfers are executed to favor the owner family, minority shareholders could face share dilution or distorted valuations. While the family may boost its stake, general investors could be left holding weakened equity.

A PharmaResearch spokesperson stated, “We will fully comply with legal procedures to ensure the rights of minority shareholders are not harmed. We are also open to various institutional safeguards, should they be necessary, to protect shareholder interests.”

The company added, “The newly established PharmaResearch will aim to return 30% of their net profit to shareholders. The surviving holding company, PharmaResearch Holdings, currently has no concrete dividend policy but will announce one when the business stabilizes.”

|

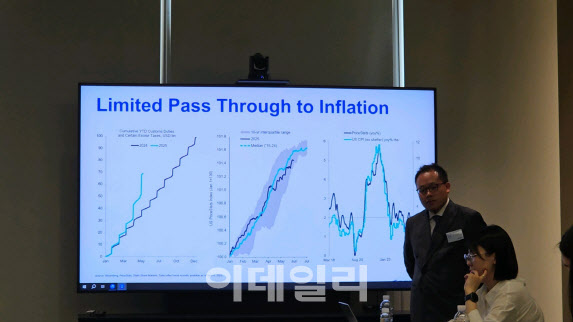

| Nibec chart(Cred=KG Zeroin MP DOCTOR) |

Nibec Gains on CB Conversions, Financial Structure Improves

Nibec, which recently announced a major license-out deal, saw further positive momentum with CB conversions that improved its debt ratio. Shares closed up 7.98% at KRW 28,400. A Pharmedaily premium article published on June 11 also appears to have contributed to investor interest.

Founded in 2004 as a manufacturer of dental bone grafts, Nibec listed on KOSDAQ in 2011. Since 2017, it has expanded its peptide applications from dental to stem cell, oncology, and now obesity treatments.

In Q1 2025, Nibec posted KRW 5.6 billion in revenue, down 12% YoY. Operating profit swung from KRW 300 million in the black to a KRW 1.2 billion loss, while net income flipped from a KRW 200 million profit to a KRW 1.5 billion loss.

Over 90% of its revenue still comes from dental graft and periodontal regeneration products. However, the recent non-dental license-out deal marked a meaningful step for diversification.

On May 28, Nibec signed a license-out deal for its peptide-based fibrosis therapy NP-201 with a U.S.-based biopharma company. The total deal is valued at USD 435 million, with an upfront payment of USD 8 million --about 1.8% of the total and 44.6% of Nibec’s FY24 revenue (KRW 24.5 billion).

NP-201 has completed Phase 1 trials in Australia and is preparing for Phase 2. The U.S. partner gains exclusive global rights for development and commercialization.

The license-out news also triggered convertible bond conversions, improving Nibec’s balance sheet. Nibec issued KRW 25 billion in CBs (8th series) in November 2022, acquired by Ace Investment, DB Financial, Mirae Asset, and KB Securities. On June 4, a week after the license-out deal, KRW 3.3 billion worth of bonds were converted, leaving KRW 3.7 billion in unconverted bonds. The bonds mature in November 2027 with a 3% interest, and this partial conversion is seen as a favorable turnout for Nibec.

A Nibec official said, “We are in joint R&D talks with one of the global top-3 pharma companies involving a peptide platform with license-out options. We are also collaborating with Daiichi Sankyo on a BBB-shuttle program, and with Sarepta Therapeutics on a gene therapy delivery platform through an MTA (Material Transfer Agreement). We are engaged in multiple licensing discussions that are expected to drive future revenue growth.”

17 hours ago

1

17 hours ago

1

!['차세대 원전' SMR 관련주 들썩…태웅, 한 달새 117% 급등[주톡피아]](https://image.edaily.co.kr/images/Photo/files/NP/S/2025/06/PS25061701365.jpg)

![천하람 “국민의힘, 죽어버린 나무…물 줄 필요 있나” [정치를 부탁해]](https://dimg.donga.com/wps/NEWS/IMAGE/2025/06/02/131732216.1.jpg)

![조승래 “지귀연 판사 제보 여러건…법원-공수처가 확인해야” [정치를 부탁해]](https://dimg.donga.com/wps/NEWS/IMAGE/2025/05/19/131636504.1.jpg)

![[포토] 투표용지 인쇄 시작](https://img.hankyung.com/photo/202505/AA.40611422.1.jpg)

English (US) ·

English (US) ·